I want to take a minute of your time, as I believe it will change the way you think about your money and may even inspire you to be part of something bigger than yourself. Like any other millennial, I lived on the edge and always sought out new experiences that could help me become a better person but only recently did I start thinking about the impact that my actions have on the people around me and my community.

After graduating from college, I barely made ends meet and like many graduates, it took me a few weeks to find a job. A few years later, after acquiring good experience, I was able to find a steady job; one that paid me enough to start saving money for my family.

Banks Were Not For Me

I realized soon that I could not go on hiding my money in some secret drawer at home so I started to figure out my options. Just like most people, I saw that I could deposit my money in a bank so I opened an account.

A few months later, I joined SORIN, the Social Responsibility Innovator and was quite concerned to learn that banks had free reign over 90 percent of my money. They use it to lend to others and trap many people in the endless cycle of debt, which is a lose-lose proposition. At the core, banks are for profit businesses and are obligated to make money for their shareholders.

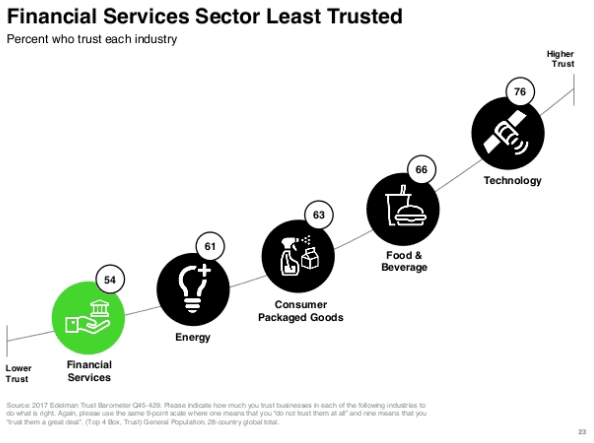

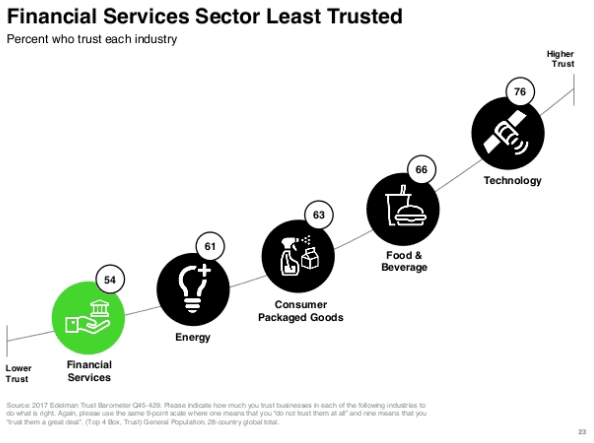

It is no wonder then that the financial services industry at large, including banks, is the least trusted.

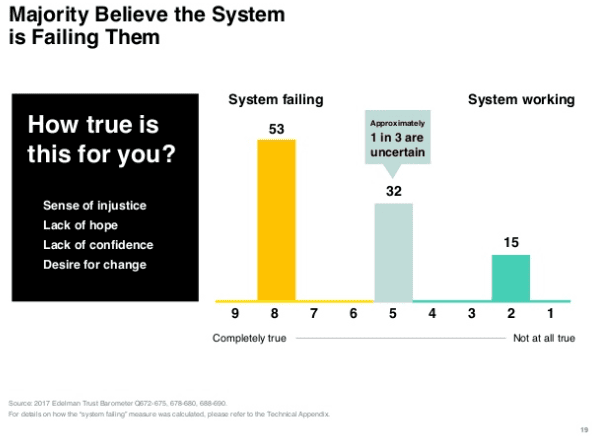

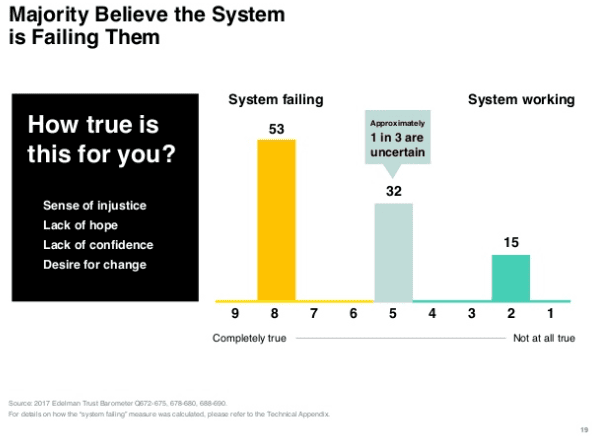

More concerning, the 2017 Edelman Trust Barometer demonstrates how most of us consider the financial system broken and sadly we lack the confidence that it can be reformed. We are open to positive change but lack hope and confidence that it will happen.

So What About a Credit Union?

Having realized what banks do with my money, I searched again for a better option. This led me to credit unions. I had not realized that over 100 million people use them for their banking needs. The three facts that convinced me that credit unions are the best option were:

- Credit unions always put their account holders or members first because they are owned by them meaning that members have a say in how they operate.

Credit unions are not for profit so they are not driven by maximizing profits for shareholders. They pass their profits on to members in the form of lower fees and higher savings rates.

Ultimately, the goal of a credit union is to bring people together so they can cooperate in helping one another with their financial needs.

The First of Its Kind Debt-Free Credit Union

Just as I am determined to make a difference and become an ambassador of change so is SORIN, a nonprofit dedicated to help “foster the creation of an inclusive financial landscape that is, at its core both responsible and profitable.” As a member of SORIN, I’m excited to share with you that we are taking credit unions to a whole new level.

SORIN is sponsoring a credit union that will not only provide all the expected benefits but will, for the first time, offer financial products and services that will always be interest and debt-free. I became a member so I could work on this project. Our credit union will serve as the foundation to help build wealth for our members and steer our collective funds in the service of mutual good without taking advantage of anyone, especially when they are most vulnerable.

I

nequality and debt are linked at the hip. For this reason, I sought to help create solutions that will empower us to build prosperity and wealth for ourselves and our families. I invite you to join me and become a member of SORIN and an owner of our credit union. Your first mission is to take the credit union survey; so you too can become part of our credit union that will never put you in debt.